All Categories

Featured

Table of Contents

Eliminating representative compensation on indexed annuities permits significantly greater detailed and actual cap rates (though still significantly less than the cap prices for IUL plans), and no question a no-commission IUL plan would push detailed and real cap prices higher too. As an aside, it is still possible to have an agreement that is very rich in representative compensation have high early money surrender worths.

I will certainly acknowledge that it is at least theoretically POSSIBLE that there is an IUL policy out there issued 15 or 20 years ago that has supplied returns that are superior to WL or UL returns (much more on this below), but it's vital to much better comprehend what an appropriate contrast would certainly involve.

These policies commonly have one bar that can be established at the business's discretion annually either there is a cap price that defines the maximum crediting price because particular year or there is a participation price that specifies what percentage of any type of favorable gain in the index will be passed along to the policy because specific year.

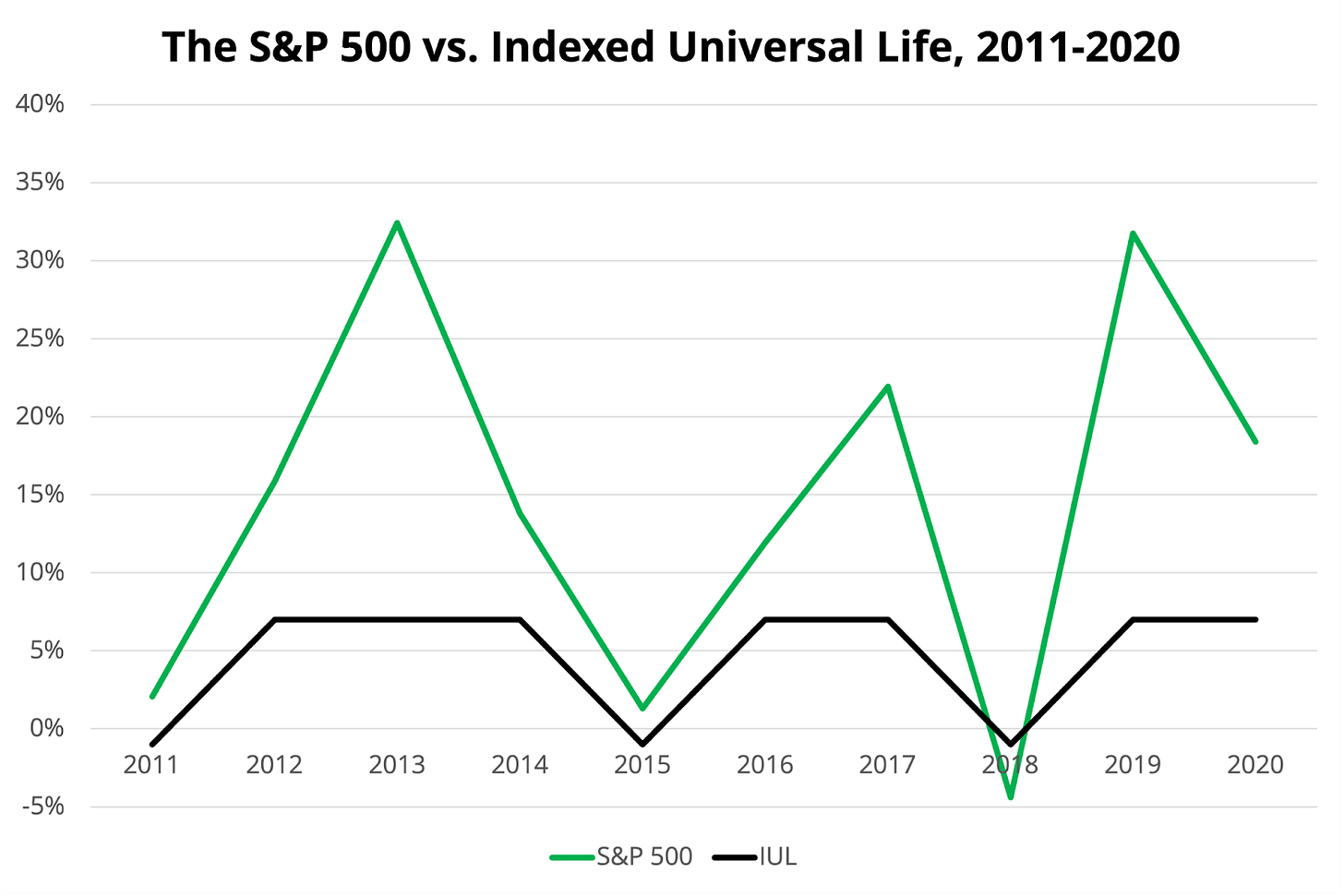

And while I generally agree with that characterization based upon the technicians of the policy, where I take problem with IUL proponents is when they define IUL as having superior go back to WL - index universal life insurance vs whole life. Numerous IUL advocates take it a step even more and point to "historic" data that seems to support their cases

There are IUL plans in presence that bring even more danger, and based on risk/reward concepts, those policies must have greater expected and actual returns. (Whether they actually do is an issue for significant argument yet companies are utilizing this method to assist justify greater detailed returns.) As an example, some IUL plans "double down" on the hedging technique and evaluate an extra cost on the policy every year; this fee is after that made use of to raise the options budget; and then in a year when there is a favorable market return, the returns are magnified.

Universal Life Insurance Ratings

Consider this: It is possible (and actually likely) for an IUL plan that averages an attributed rate of say 6% over its initial 10 years to still have a total unfavorable rate of return during that time because of high charges. Many times, I find that agents or consumers that extol the performance of their IUL policies are puzzling the credited rate of return with a return that effectively shows all of the plan charges as well.

Next we have Manny's inquiry. He says, "My close friend has been pushing me to purchase index life insurance policy and to join her organization. It looks like an online marketing. Is this an excellent idea? Do they truly make just how much they state they make?" Let me start at the end of the question.

Insurance sales people are not bad individuals. I utilized to offer insurance at the start of my career. When they offer a premium, it's not unusual for the insurance policy business to pay them 50%, 80%, even often as high as 100% of your first-year premium.

It's difficult to market because you obtained ta constantly be looking for the following sale and going to find the next individual. It's going to be hard to discover a whole lot of fulfillment in that.

Let's talk about equity index annuities. These things are prominent whenever the markets are in an unpredictable duration. You'll have abandonment durations, generally seven, 10 years, maybe also past that.

No Lapse Life Insurance

That's just how they know they can take your cash and go fully invested, and it will be okay because you can not obtain back to your money until, once you're into 7, 10 years in the future. No issue what volatility is going on, they're probably going to be fine from an efficiency point ofview.

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your busy life, economic freedom can appear like a difficult objective.

Pension, social safety, and whatever they 'd managed to conserve. However it's not that very easy today. Fewer companies are providing traditional pension and many companies have lowered or stopped their retirement plans and your capability to rely exclusively on social safety remains in concern. Even if advantages haven't been minimized by the time you retire, social security alone was never ever meant to be sufficient to spend for the lifestyle you desire and should have.

Maximum Funded Tax Advantaged Insurance Contracts

/ wp-end-tag > As component of a sound monetary strategy, an indexed global life insurance policy can help

you take on whatever the future brings. Prior to committing to indexed global life insurance policy, right here are some pros and cons to think about. If you pick an excellent indexed universal life insurance coverage strategy, you might see your cash money worth grow in value.

Given that indexed global life insurance calls for a particular degree of danger, insurance policy companies tend to keep 6. This type of strategy likewise uses.

Last but not least, if the picked index does not perform well, your cash value's growth will certainly be impacted. Usually, the insurance provider has a vested rate of interest in doing much better than the index11. There is normally an ensured minimum interest price, so your strategy's development won't drop below a particular percentage12. These are all elements to be taken into consideration when selecting the most effective kind of life insurance policy for you.

Considering that this type of policy is more complex and has an investment part, it can commonly come with higher premiums than various other policies like whole life or term life insurance. If you don't think indexed universal life insurance policy is appropriate for you, here are some choices to consider: Term life insurance policy is a short-term policy that typically offers coverage for 10 to 30 years.

The Difference Between Whole Life And Universal Life Insurance

Indexed universal life insurance policy is a kind of plan that provides a lot more control and flexibility, together with higher cash money worth growth capacity. While we do not provide indexed universal life insurance policy, we can provide you with even more info concerning whole and term life insurance policy policies. We advise checking out all your options and talking with an Aflac agent to uncover the best suitable for you and your family.

The remainder is contributed to the cash money value of the policy after fees are deducted. The cash money value is attributed on a month-to-month or annual basis with interest based on increases in an equity index. While IUL insurance policy might show valuable to some, it is necessary to recognize just how it works before buying a policy.

Latest Posts

Group Universal Life Cash Accumulation Fund

Equity In Life Insurance

Universal Life Insurance Tax Benefits